Description

This opportunity will be financed under the Earlyfunding system. See here the conditions

WECITY complies with Law 5/2015 and with Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European providers of crowdfunding services for companies. It is authorized by the CNMV as a Participatory Financing Platform registered under number 30, with a favorable proposal from the Bank of Spain.

Blue Gavina Homes SL, requests financing from wecity for this investment opportunity. Investor, before making your investment please read the basic information for the investor client.

Skin in the game: “In compliance with Article 8.2 of Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European providers of equity financing, we hereby inform you that partners, managers and employees of wecity may invest in this opportunity. These investments will be made under the same conditions as those of other investors without receiving preferential treatment or privileged access to information.”

The investment

The developer requests from wecity a fixed-rate loan with a 1st degree mortgage guarantee for an amount of €650,000 corresponding to phase I of the total financing, which may be increased to a maximum of €1,100,000 in two phases. The purpose of the financing is to cover the construction costs until the homes are delivered to the buyers, once the First Occupancy License has been obtained.

The exit of the investors from wecity occurs with the sale and delivery of the homes to the buyers.

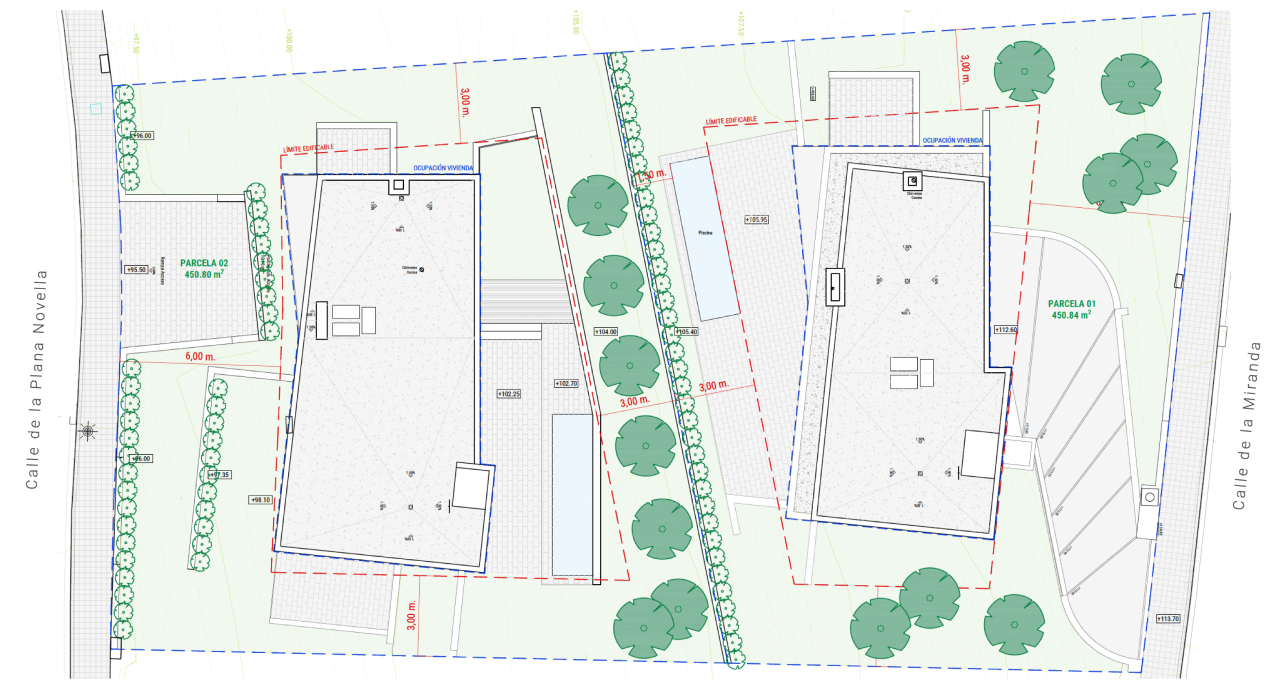

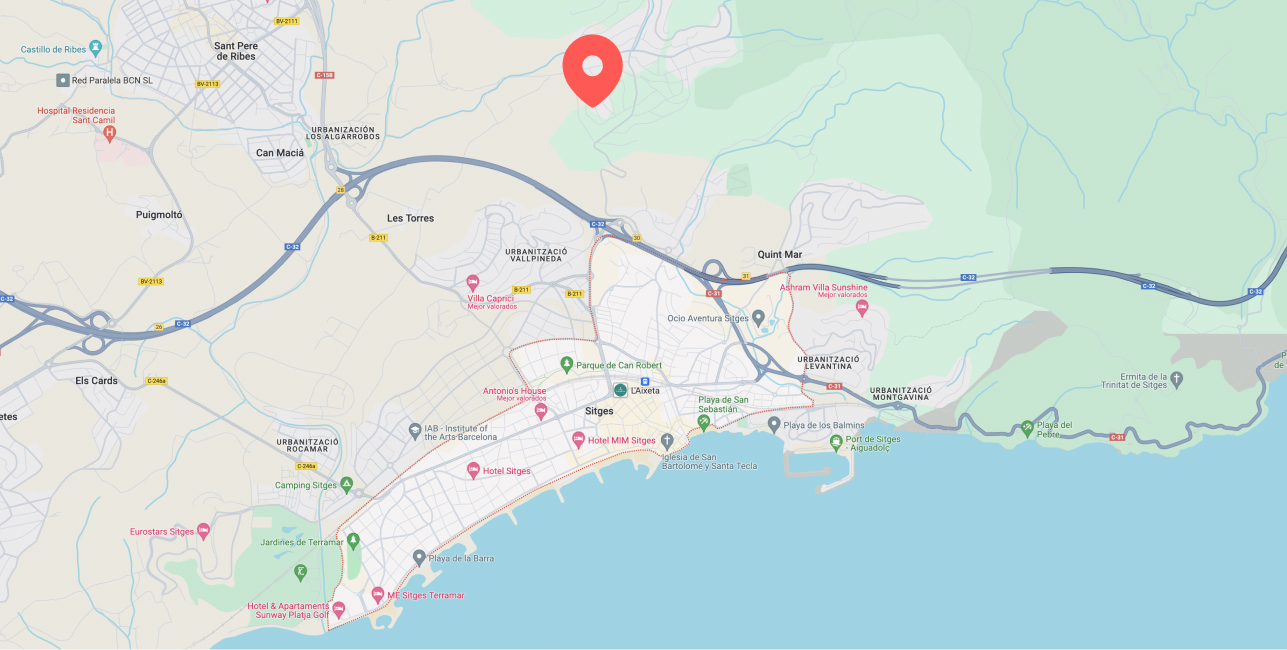

The site is located at 36 Miranda Street, in the Mas Alba urbanization, Sant Pere de Ribes (Barcelona), just 10 minutes from the center of Sitges. The project consists of the promotion of 2 luxury villas of more than 300 m2, which are developed on plots of 450 m2. Both homes have 4 bedrooms and enjoy excellent views both from the house and from the infinity pool. The developer has started marketing in March 2024.

The developer is providing its own funds in this phase I in the amount of €250,000 (27.77%) which, together with the €650,000 requested from the wecity investors, add up to a total of €900,000 required to start the works. The activation of the second phase of the loan will be conditioned to a contribution of funds by the developer of €150,000.

Through wecity you can participate in a fixed-rate loan operation with an annual interest rate of 11% for an estimated term of 18 months (6 months mandatory) with a possibility of extension for an additional 6 months.

With a minimum investment of 500 €, you can participate in this opportunity with an excellent profitability and with the maximum guarantees. The estimated total return is 16.5% for 18 months or 22% if the final term is with the 6 month extension.

The promoter will make an annual payment of ordinary interest + another payment of ordinary interest together with the amortization of the principal at the maturity of the project.

Keys for investment

- Purpose of the loan: Construction costs of a real estate development of 2 luxury villas located at 36 Miranda Street, Mas Alba urbanization, Sant Pere de Ribes (Barcelona).

- Guarantee: 1st degree mortgage.

- Term: 18 months (+ 6 months possible extension).

- Interest rate: 11% per annum.

- Estimated total yield: 16.5%.

- Interest payment: annual and at maturity.

- Current ECO appraisal: €211,760 (LTV: 306%).

- ECO HET appraisal: €1,792,617 (LTV HET: 61.36%).

- LTV 1st disposition: 46.27%.

- Contributions:

- Developer’s own funds phase I: €250,000 (The developer will owe an additional €150,000 for the activation of the second phase).

- Investors wecity phase I: €650,000.

- Minimum investment: 500 €.

- Maximum investment: No limits.

ECO Valuation

The current appraisal for mortgage guarantee purposes (ECO Order 805/2003) amounts to €211,760. This represents a Loan to Value (LTV) over the current appraisal of 306%.

The appraisal on the assumption of a finished building amounts to € 1,792,617. This represents a Loan to Value (LTV) over HET appraisal of 61.36%.

The Loan to Value (LTV) on first disposal is 46.27%.

The independent appraiser in charge of identifying the value is KRATA, whose corporate name is Krata SA, and is registered as an Approved Appraisal Company by the Bank of Spain under number 4323.

The project

The project consists of the development of 2 luxury villas in Miranda street, 36, Mas Alba urbanization, Sant Pere de Ribes (Barcelona).

Plot plan (you can see the rest of the plans in the Documents section)

Location

Located between the towns of Sant Pere de Ribes and Sitges, in the province of Barcelona, this destination has become one of the most outstanding tourist spots in the region. Its privileged location, between the Mediterranean Sea and the mountains of the Garraf Park, offers visitors a unique experience, full of leisure opportunities, as well as an attractive potential for those looking to invest in real estate.

The luxury residential developments, golf courses and modern nautical facilities along the beaches are perfectly complemented by the town center of Sitges, which is brimming with cultural life and events.

The mortgage guarantee

The loan will be secured by a 1st degree mortgage on the asset and the building, located at 36 Miranda Street, Mas Alba urbanization, Sant Pere de Ribes (Barcelona).

According to the appraisal report carried out by Krata, the current appraisal amounts to €211,760. The loan to be made to the developer is 650,000 €, which means a Loan to Value (LTV) on the current appraisal of 306% and a Loan to Value of 1st disposal of 46.27%.

The HET appraisal (finished building hypothesis) amounts to €1,792,617, which represents a Loan to Value HET of 61.36% (phase I and II).

Guarantee agent

The constitution, preservation, management, administration and, if applicable, enforcement of the real estate mortgage rights on behalf of the investors will be carried out by an entity external to wecity.

In this case the designated Collateral Agent is BONDHOLDERS.

Bondholders, is a professional company specialized mainly in providing independent commission agent and escrow services over different asset classes and under numerous international jurisdictions.

In recent years Bondholders has been mandated as agent and arranger in more than 400 transactions representing a total of nearly 200 billion euros in debt.

Its main clients include, among others, financial institutions, institutional clients, asset managers, sovereign government agencies.

Currently one of the leaders in Europe in providing independent fiduciary services.

Monitoring

The promoter must justify the use of the funds in each of the applications. The use of the funds by the promoter will be monitored by a company external to wecity.

Compliance with Regulation (EU) 2020/1503 🇪🇺

Risk warning

Investing in this crowdfunding project involves risks, including the risk of partial or total loss of the money invested. Your investment is not covered by the deposit guarantee schemes established in accordance with Directive 2014/49/EU of the European Parliament and of the Council (*). Your investment is not covered by the investor compensation schemes established in accordance with Directive 97/9/EC of the European Parliament and of the Council (**). You may not get any return on your investment. This is not a savings product and you are advised not to invest more than 10% of your net wealth in crowdfunding projects. You may not be able to sell the investment instruments whenever you want. Even if you can assign them, you could suffer losses.

Pre-contractual cooling-off period for inexperienced investors

Inexperienced investors have a cooling-off period of four (4) days during which they can, at any time, revoke or withdraw, at any time, from their investment offer or expression of interest in the participatory financing offer without having to justify their decision and without incurring a penalty. The cooling-off period begins at the moment when the potential inexperienced investor makes an investment offer or expresses interest and expires four calendar days from that date. To exercise their right of revocation, Investors may send an email to the following address: reclamaciones@wecity.io, filling in the “subject” field of the email as follows: “REVOCATION – Name of the Opportunity – Full name of the Investor”. In the event that a monetary contribution has been made in connection with the financing offer, this amount will be returned as soon as possible to the wallet that, as an investor/user of the ‘WECITY’ Platform, has been opened in the Payment Institution ‘LEMONWAY’.

Credit risk

Credit risk is defined as the loss that may occur in the event of non-payment by the counterparty in a financial transaction. In this specific case, the risk that the Promoter will not pay the principal and/or interest of the Loan.

Sector risk Risks inherent to the specific sector.

These risks may be caused, for example, by a change in macroeconomic circumstances, a reduction in demand in the sector in which the participatory financing project operates and dependencies on other sectors. In any case, the investor must bear in mind that adverse economic conditions or cyclical changes may lead to a weakening of the Promoter’s ability to meet its financial commitments in relation to the loan.

Risk of default

The risk that the project developer may be subject to insolvency proceedings and other events affecting the project or the project developer that result in the loss of the investment for the investors. These risks may be caused by a variety of factors, including, but not limited to: (serious) change in macroeconomic circumstances, mismanagement, lack of experience, fraud, financing not fitting with the corporate purpose, failure in the product launch or lack of liquidity. In the event of the Promoter’s bankruptcy, the holders of the credits will be considered as credits with special privilege, as they are secured by a mortgage guarantee, in accordance with the cataloguing and order of priority of credits established by Royal Legislative Decree 1/2020, of May 5, which approves the revised text of the Bankruptcy Law (hereinafter, the “Bankruptcy Law”), except for those amounts that, in accordance with Article 272 of the Bankruptcy Law, should be classified either as ordinary credit or as subordinated credit, as appropriate.

Risk of lower or delayed return

The risk that the return will be lower than expected or that the project will default on the payment of principal or interest.

Risk of illiquidity of the investment

The risk that investors will not be able to sell their investment. There is no active trading market for the loan, so it is possible that the investor will not be able to find a third party to whom to assign the loan.

Other risks

Risks that are, among others, beyond the control of the project developer, such as political or regulatory risks.

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section