Description

WECITY complies with the provisions of Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European providers of participative financing services for companies and Title V of Law 5/2015 on the promotion of business financing as amended by Law 18/2022 of 28 September on the creation and growth of companies. It is authorized by the CNMV as a Participatory Financing Service Provider, registered in the registry under number 9, with a favorable proposal from the Bank of Spain.

Investor, before making your investment, please read the basic information for the investor client, as well as the pre-contractual cooling-off period for inexperienced investors .

Skin in the game: “In compliance with Article 8.2 of Regulation (EU) 2020/1503 of the European Parliament and of the Council of October 7, 2020 on European providers of equity financing, it is hereby informed that in this opportunity partners, managers and employees of wecity may invest. These investments will be made under the same conditions as those of other investors without receiving preferential treatment or privileged access to information.”

The investment

- Purpose of the loan: To finance construction costs.

- Collateral:1st degree mortgage (c/Beatriz de Suabia 21)

- Collateral: 2nd degree mortgage (c/Peral 19- 21)

- Term: 12 months (+6 months possible extension)

- Required compliance: 6 months.

- Interest rate: 11.50% p.a.

- Estimated total return: 11.50%

- Interest payment: at maturity.

- C/Beatriz de Suabia 21 – First Rank

- Current Valuation (ECO2): 1.222.971,67 €

- HET appraisal (ECO2): N/A | LTV: 35,58%

- C/Peral 19- 21 – Second Range

- Current Valuation (ECO2): 1.437.149,26 €

- HET appraisal (ECO2): 2.587.185,33 €

- Bank Debt: 1.393.000,00 €

- LTVs

- Current LTV 1st rank: 70.32%

- Current LTV 1st and 2nd rank: 67.87%

- LTV HET: 35.58%

- 1st Drawing: 348,112.00 € | LTV 1st Drawing: 27.47%

- Rating: A

- Contributions:

- Promoter: 727,250.34 €

- Wecity loan: 860,000 €

- Minimum investment: 500 €

- Maximum investment: 500 € for the first half hour.

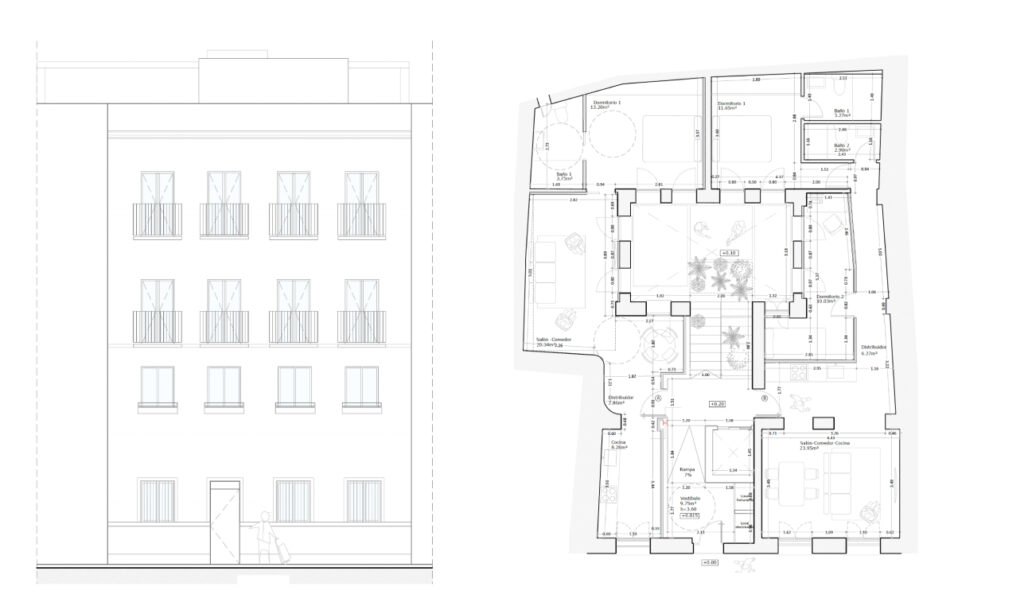

The developer Desarrollo, Gestión, Reactivación y Promoción Inmobiliaria en Sevilla SL is seeking financing through wecity for the renovation of a historic property in Seville, located at Calle Peral 19-21, which has eight residential units.

The developer has already purchased the property, has begun the renovation (54% of the work is complete) and is requesting a loan of €860,000 to complete the renovation.

To date, the developer has contributed €727,250.34 (46%) of its own funds towards the construction costs, technical expenses and part of the acquisition of the property.

As collateral, the developer offers a second-rank mortgage guarantee on the asset, on which Banco Santander has a mortgage for €1,393,000 (HET value €2,587,185.33). As additional collateral, a first mortgage is provided on an asset owned by the borrowing company, located at Calle Beatriz de Suabia 21. The loan amount will be used to cancel an outstanding charge of €340,000 on the asset at Beatriz de Suabia 21 and the remainder to finance the work on the asset at Calle Peral 19-21.

At present, there are no sales, and the estimated average sale price for each of the eight homes is €360,000.

The exit of the investors from wecity is planned with the sale of the eight homes at Calle Peral 19-21.

Through wecity you can participate in a fixed rate loan operation with an annual interest rate of 11.50% for an estimated term of 12 months (6 months mandatory) with the possibility of extending for an additional 6 months .

The payment of interest plus the return of the invested capital will be made at maturity.

The project

Location and surroundings

Calle Peral, 19 is located in the historic center of Seville, in an area with excellent connections and services. A few minutes walk away are bus stops such as Calatrava and Resolana, which connect with different parts of the city. In addition, it is well connected to the suburban train lines (C1 and C2) and about 10 minutes by car from the Metro (Line 1), which guarantees agile mobility both inside and outside the old town.

In the immediate surroundings there are several educational centers, such as the Doctor Sacristan School, as well as kindergartens and public and subsidized centers. It is also close to reference hospitals such as the Virgen Macarena and Virgen del Rocío University Hospitals, as well as private medical centers. All this makes this location an attractive option for families, investors and residential projects, thanks to its consolidated environment and high demand.

Mortgage collateral

The loan will be secured by a first mortgage on the asset located at Calle Beatriz de Suabia, 21, and a second mortgage on the asset located at Calle Peral 19-21, Seville.

According to the appraisal reports prepared by Risc Valor, the current appraisal of the asset located at Beatriz de Suabia, 21 amounts to € 1,222,971.67. In the case of the asset located at Calle Peral 19-21, the current appraisal is 1,437,149.26 €, and the HET appraisal (Hypothesis of Completed Building) is 2,587,185.33 €. The existing bank debt on the latter is 1,393,000.00 €.

The loan to be made to the developer contemplates the following metrics: a Loan to Value (LTV) over current appraisal in the first range of 70.32 %, an LTV over current appraisal considering the first and second ranges of 67.87 %, and an LTV over the Completed Building Assumption (CBA) of 35.58 %. The first drawdown of the loan will be €348,112.00, which represents an LTV 1st Drawing of 27.47%.

Collateral agent

The constitution, conservation, management, administration and, if applicable, enforcement of the pledge on behalf of wecity’s investors shall be carried out by an entity external to wecity.

In this case, the designated Collateral Agent will be the one indicated in the loan agreement.

Rating

wecity, as a provider of equity financing services and in compliance with Delegated Regulation (EU) 2024/358 supplementing Regulation (EU) 2020/1503 of the European Parliament and of the Council, provides a description of the credit rating method

of the projects used to calculate the ratings. If the calculation is based on accounts that have not been audited, this shall be clearly stated in the description of the method.

Monitoring

The promoter must justify the use of the funds in each of the applications. The use of the funds by the promoter will be monitored by a company external to wecity.

Compliance with Regulation (EU) 2020/1503 🇪🇺

Risk warning

Investing in this crowdfunding project involves risks, including the risk of partial or total loss of the money invested. Your investment is not covered by the deposit guarantee schemes established in accordance with Directive 2014/49/EU of the European Parliament and of the Council (*). Your investment is not covered by the investor compensation schemes established in accordance with Directive 97/9/EC of the European Parliament and of the Council (**). You may not get any return on your investment. This is not a savings product and you are advised not to invest more than 10% of your net wealth in crowdfunding projects. You may not be able to sell the investment instruments whenever you want. Even if you can assign them, you could suffer losses.

Pre-contractual cooling-off period for inexperienced investors

Inexperienced investors have a cooling-off period of four (4) days during which they can, at any time, revoke or withdraw, at any time, from their investment offer or expression of interest in the participatory financing offer without having to justify their decision and without incurring a penalty. The cooling-off period begins at the moment when the potential inexperienced investor makes an investment offer or expresses interest and expires four calendar days from that date. To exercise their right of revocation, Investors may send an email to the following address: reclamaciones@wecity.io, filling in the “subject” field of the email as follows: “REVOCATION – Name of the Opportunity – Full name of the Investor”. In the event that a monetary contribution has been made in connection with the financing offer, this amount will be returned as soon as possible to the wallet that, as an investor/user of the ‘WECITY’ Platform, has been opened in the Payment Institution ‘LEMONWAY’.

Credit risk

Credit risk is defined as the loss that may occur in the event of non-payment by the counterparty in a financial transaction. In this specific case, the risk that the Promoter will not pay the principal and/or interest of the Loan.

Sector risk Risks inherent to the specific sector.

These risks may be caused, for example, by a change in macroeconomic circumstances, a reduction in demand in the sector in which the participatory financing project operates and dependencies on other sectors. In any case, the investor must bear in mind that adverse economic conditions or cyclical changes may lead to a weakening of the Promoter’s ability to meet its financial commitments in relation to the loan.

Risk of default

The risk that the project developer may be subject to insolvency proceedings and other events affecting the project or the project developer that result in the loss of the investment for the investors. These risks may be caused by a variety of factors, including, but not limited to: (serious) change in macroeconomic circumstances, mismanagement, lack of experience, fraud, financing not fitting with the corporate purpose, failure in the product launch or lack of liquidity. In the event of the Promoter’s bankruptcy, the holders of the credits will be considered as credits with special privilege, as they are secured by a mortgage guarantee, in accordance with the cataloguing and order of priority of credits established by Royal Legislative Decree 1/2020, of May 5, which approves the revised text of the Bankruptcy Law (hereinafter, the “Bankruptcy Law”), except for those amounts that, in accordance with Article 272 of the Bankruptcy Law, should be classified either as ordinary credit or as subordinated credit, as appropriate.

Risk of lower or delayed return

The risk that the return will be lower than expected or that the project will default on the payment of principal or interest.

Risk of illiquidity of the investment

The risk that investors will not be able to sell their investment. There is no active trading market for the loan, so it is possible that the investor will not be able to find a third party to whom to assign the loan.

Other risks

Risks that are, among others, beyond the control of the project developer, such as political or regulatory risks.

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section