Description

WECITY complies with the provisions of Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European providers of participative financing services for companies and Title V of Law 5/2015 on the promotion of business financing as amended by Law 18/2022 of 28 September on the creation and growth of companies. It is authorized by the CNMV as a Participatory Financing Service Provider, registered in the registry under number 9, with a favorable proposal from the Bank of Spain.

Investor, before making your investment, please read the basic information for the investor client, as well as the pre-contractual cooling-off period for inexperienced investors .

Skin in the game: “In compliance with Article 8.2 of Regulation (EU) 2020/1503 of the European Parliament and of the Council of October 7, 2020 on European providers of equity financing, it is hereby informed that in this opportunity partners, managers and employees of wecity may invest. These investments will be made under the same conditions as those of other investors without receiving preferential treatment or privileged access to information.”

The investment

- Purpose of the loan: To finance construction costs.

- Collateral:1st degree mortgage

- Deadline: 15 months (+6 months possible extension)

- Required compliance: 6 months

- Interest rate: 11.50% p.a.

- Estimated total return: 14.38%

- Interest payment: at maturity

- ECO appraisal (current): 469,309.94 € Current LTV: 138.50%

- HET appraisal (current): 1,690,759.08 € LTV HET: 38.44%

- Rating: AA

- Contributions:

- Promoter: 550.000,00 €

- Wecity loan: 650,000.00 €

- Minimum investment: 500 €

- Maximum investment: 500 € for the first half hour

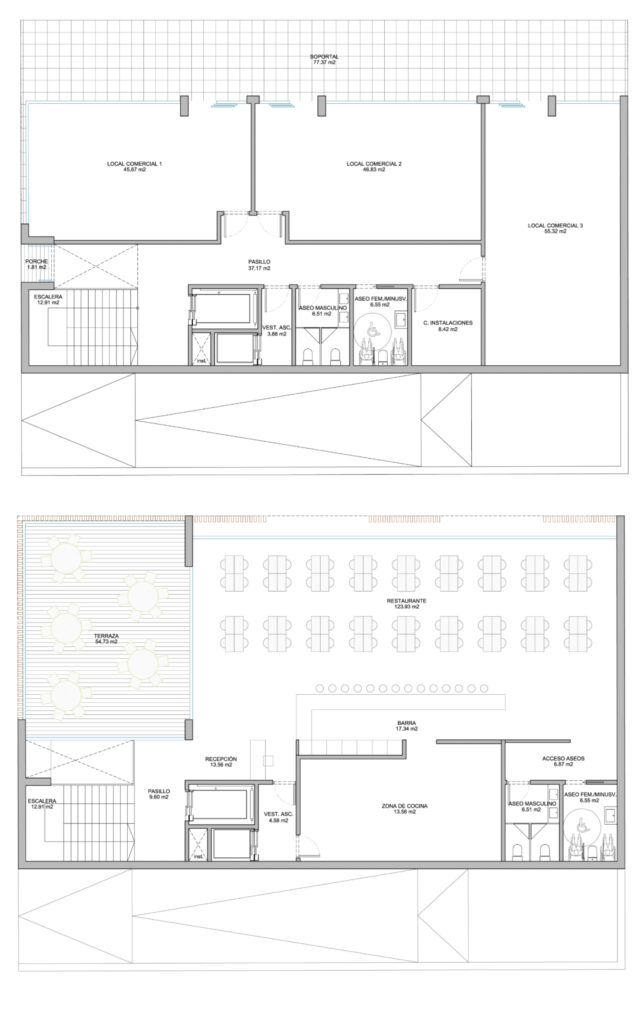

The developer Koul Construcción Inteligente SL, requests financing through wecity for the development of a building consisting of 4 commercial premises in San Sebastián de los Reyes, Madrid.

Three of the premises are on the first floor and one on the second floor, which will have a terrace. In addition, the building has a roof terrace and parking spaces. The total area of the asset is 432.00 sq. m.2and a buildable area of 949.58m2.

The developer has already acquired the site and has managed the architectural projects until the building permit is obtained.

The project will be financed through a fixed-rate mortgage loan of €650,000, which will be secured by a first mortgage guarantee and will have a term of 15 months (+6 months of possible extension).

To date, the developer has contributed its own funds amounting to €550,000, which have been used for the acquisition of the land, the architectural project and the building permit. the exit of wecity ‘s investors may occur with the sale of the premises or the entry of bank financing.

Through wecity you can participate in a fixed rate loan operation with an annual interest rate of 11.50% for an estimated term of 15 months (6 months mandatory) with the possibility of extending for an additional 6 months at .

The payment of interest plus the return of the invested capital will be made at maturity.

The project

Location and surroundings

San Sebastián de los Reyes is a municipality north of Madrid, well connected and in full real estate growth. It offers a wide range of services and excellent connectivity with the capital, which makes it an attractive place for both residents and investors. Near Calle Santa Teresa de Jesús 15, there are spaces such as La Viña Shopping Center and Parque de la Marina, which provide comfort and leisure. In addition, the San Sebastián de los Reyes commuter train station provides direct access to Madrid. With more affordable prices than other nearby areas, and a good range of businesses, such as the Industrial Park of Los Berrocales, it is an ideal option for families and professionals looking for tranquility and proximity to the capital.

Mortgage collateral

The loan will be secured by a1st degree mortgage on the asset, located at Blvr. Picos de Europa, San Sebastián de los Reyes(Madrid).

According to the appraisal report prepared by EUROVAL, the current appraisal amounts to €469,309.94 and the HET appraisal amounts to €1,690,759.08. The loan to be made to the developer is 650,000 €, which means a Loan to Value (LTV) on current appraisal of 138.50%, a Loan to Value (LTV) on Completed Building Assumption (HET) of 38.44% and a Loan to Value (LTV) on first drawdown of 38.08%.

Collateral agent

The constitution, conservation, management, administration and, if applicable, enforcement of the pledge on behalf of wecity’s investors shall be carried out by an entity external to wecity.

In this case, the designated Collateral Agent will be the one indicated in the loan agreement.

Rating

wecity, as a provider of equity financing services and in compliance with Delegated Regulation (EU) 2024/358 supplementing Regulation (EU) 2020/1503 of the European Parliament and of the Council, provides a description of the credit rating method

of the projects used to calculate the ratings. If the calculation is based on accounts that have not been audited, this shall be clearly stated in the description of the method.

Monitoring

The promoter must justify the use of the funds in each of the applications. The use of the funds by the promoter will be monitored by a company external to wecity.

Compliance with Regulation (EU) 2020/1503 🇪🇺

Risk warning

Investing in this crowdfunding project involves risks, including the risk of partial or total loss of the money invested. Your investment is not covered by the deposit guarantee schemes established in accordance with Directive 2014/49/EU of the European Parliament and of the Council (*). Your investment is not covered by the investor compensation schemes established in accordance with Directive 97/9/EC of the European Parliament and of the Council (**). You may not get any return on your investment. This is not a savings product and you are advised not to invest more than 10% of your net wealth in crowdfunding projects. You may not be able to sell the investment instruments whenever you want. Even if you can assign them, you could suffer losses.

Pre-contractual cooling-off period for inexperienced investors

Inexperienced investors have a cooling-off period of four (4) days during which they can, at any time, revoke or withdraw, at any time, from their investment offer or expression of interest in the participatory financing offer without having to justify their decision and without incurring a penalty. The cooling-off period begins at the moment when the potential inexperienced investor makes an investment offer or expresses interest and expires four calendar days from that date. To exercise their right of revocation, Investors may send an email to the following address: reclamaciones@wecity.io, filling in the “subject” field of the email as follows: “REVOCATION – Name of the Opportunity – Full name of the Investor”. In the event that a monetary contribution has been made in connection with the financing offer, this amount will be returned as soon as possible to the wallet that, as an investor/user of the ‘WECITY’ Platform, has been opened in the Payment Institution ‘LEMONWAY’.

Credit risk

Credit risk is defined as the loss that may occur in the event of non-payment by the counterparty in a financial transaction. In this specific case, the risk that the Promoter will not pay the principal and/or interest of the Loan.

Sector risk Risks inherent to the specific sector.

These risks may be caused, for example, by a change in macroeconomic circumstances, a reduction in demand in the sector in which the participatory financing project operates and dependencies on other sectors. In any case, the investor must bear in mind that adverse economic conditions or cyclical changes may lead to a weakening of the Promoter’s ability to meet its financial commitments in relation to the loan.

Risk of default

The risk that the project developer may be subject to insolvency proceedings and other events affecting the project or the project developer that result in the loss of the investment for the investors. These risks may be caused by a variety of factors, including, but not limited to: (serious) change in macroeconomic circumstances, mismanagement, lack of experience, fraud, financing not fitting with the corporate purpose, failure in the product launch or lack of liquidity. In the event of the Promoter’s bankruptcy, the holders of the credits will be considered as credits with special privilege, as they are secured by a mortgage guarantee, in accordance with the cataloguing and order of priority of credits established by Royal Legislative Decree 1/2020, of May 5, which approves the revised text of the Bankruptcy Law (hereinafter, the “Bankruptcy Law”), except for those amounts that, in accordance with Article 272 of the Bankruptcy Law, should be classified either as ordinary credit or as subordinated credit, as appropriate.

Risk of lower or delayed return

The risk that the return will be lower than expected or that the project will default on the payment of principal or interest.

Risk of illiquidity of the investment

The risk that investors will not be able to sell their investment. There is no active trading market for the loan, so it is possible that the investor will not be able to find a third party to whom to assign the loan.

Other risks

Risks that are, among others, beyond the control of the project developer, such as political or regulatory risks.

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section

You must login or be registered to view this section