Description

WECITY complies with Law 5/2015 and with Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European providers of crowdfunding services for companies. It is authorized by the CNMV as a Participatory Financing Platform registered under number 30, with a favorable proposal from the Bank of Spain.

Eurobell Inversiones SL, requests financing from wecity for this investment opportunity. Investor, before making your investment please read the basic information for the investor client.

Skin in the game: “In compliance with Article 8.2 of Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European providers of equity financing, we hereby inform you that partners, managers and employees of wecity may invest in this opportunity. These investments will be made under the same conditions as those of other investors without receiving preferential treatment or privileged access to information.”

The investment

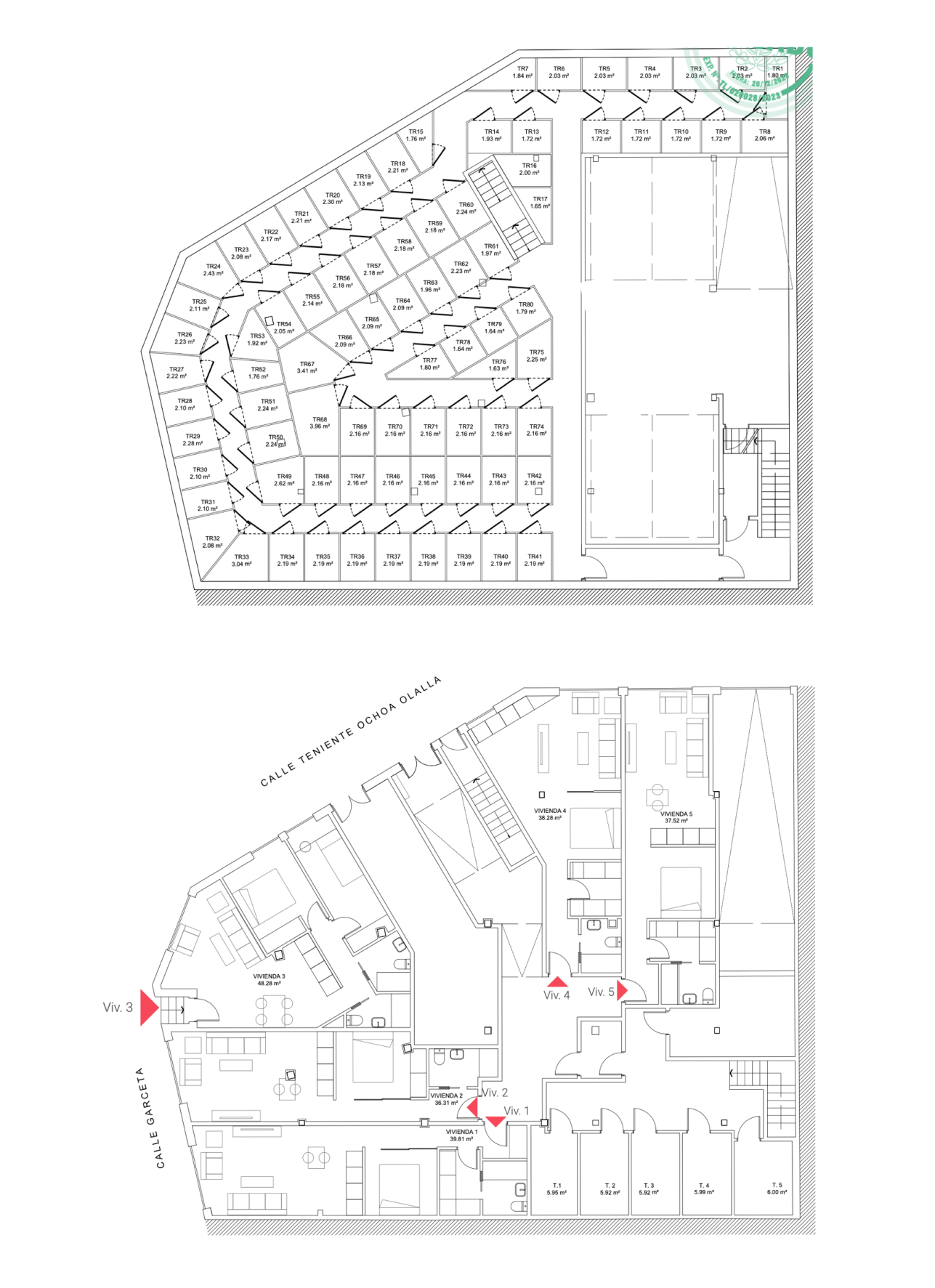

The investment opportunity consists of a loan with 1st degree mortgage guarantee, destined to finance the construction costs of the transformation of a commercial premises into 5 dwellings, 85 storage rooms and 4 parking spaces. The premises are located on the first floor and basement of a building at Calle Teniente Ochoa Olalla, 2, Madrid. The exit of wecity’s investors takes place with the delivery of the homes and storage rooms to the buyers, once the First Occupancy License and Activity License are obtained.

422,093 (37.62%) which, together with the €700,000 requested from the wecity investors, make a total of €1,122,093 required for the execution of the project. This loan has a 1st degree mortgage guarantee.

Through wecity you can participate in a fixed-rate loan operation with an annual interest rate of 10% for an estimated term of 12 months (6 months mandatory) with a possibility of extension for an additional 6 months. The total estimated return is 10% for 12 months or 15% if the final term is with the 6 month extension.

The payment of interest + the return of the invested capital will be made at maturity.

With a minimum investment of 500 € and a maximum investment of 3.000 €, you can participate in this opportunity with an excellent profitability and with the maximum guarantees.

Keys investment

- Purpose of the loan: Construction costs for the conversion of commercial premises into 5 dwellings, 85 storage rooms and 4 parking spaces at 2, Teniento Ochoa Olalla Street, Madrid.

- Guarantee: 1st degree mortgage.

- Term: 12 months (+ 6 months possible extension).

- Interest rate: 10% per annum.

- Estimated total return: 10%.

- Interest payment: at maturity

- ECO appraisal: €791,767 (current LTV: 88.41%)

- ECO HET appraisal: €1,438,826 (HET LTV: 48.65%)

- LTV First drawdown appraisal: 21.47%.

- Contributions:

- Developer’s own funds: 422,093 € (37.62%).

- WECITY investors: €700,000.

- Minimum investment: €500

- Maximum investment: €3,000

What are ECUs?

The Entidades Colaboradoras Urbanísticas (ECU) are private entities duly accredited through the ENAC (Entidad Nacional de Acreditación) to collaborate in the performance of verification, inspection and control of compliance with municipal urban planning regulations.

Recent regulations in Madrid simplify the procedures for opening or modifying real estate projects, which is beneficial for investors in the sector. The novelty is the possibility of collaborating with Entidades Colaboradoras Urbanísticas (ECU), private companies that can facilitate the obtaining of licenses and issue certificates of compliance. This change not only streamlines the process, but also provides certainty for investors by ensuring compliance and reducing potential complications during inspections. In short, the regulations create a more favorable environment for real estate investment by making permitting more efficient and cost-effective.

ECO Valuation

The current appraisal for mortgage guarantee purposes (ECO Order 805/2003) amounts to 791,767 €. This means a Loan to Value (LTV) over the current appraisal of 88.41%.

The appraisal on the assumption of a finished building amounts to € 1,438,826. This represents a Loan to Value (LTV) on HET appraisal of 48.65%.

The Loan to Value (LTV) on first disposal is 21.47%.

The independent appraiser in charge of identifying the value is ATVALOR, whose corporate name is Agrupación Técnica del Valor, and which is registered as an approved appraisal company by the Bank of Spain under number 4633.

The project

The project consists of 5 homes, 4 parking spaces and 85 storage rooms.

Basement and first floor

Location

The project is located at Calle Teniente Ochoa Olalla, 2, San Isidro (Carabanchel, Madrid).

San Isidro is a district located in the southwest of Madrid, which stands out for its proximity to the city center and its diversity of places of interest. Among them is La Pradera de San Isidro, an emblematic space where the people of Madrid congregate during the festivities in honor of the patron saint of the city.

In addition, the area offers other attractions such as the Parque Lineal del Manzanares, perfect for enjoying walks and cycling while enjoying nature in the heart of the city. San Isidro also borders Madrid Río, an urban revitalization project that transformed former industrial areas into a recreational space with parks, promenades and activities for the whole family.

With easy access from the center of Madrid and its surroundings, San Isidro benefits from its proximity to major highways such as the M-30, which circles the city, and the M-40, which connects Madrid’s various neighborhoods.

Marqués de Vadillo Street is the main artery that runs through the district, a bustling commercial corridor that brings life to the area while offering a wide variety of stores, restaurants and services, making it a point of reference for residents and visitors alike.

The mortgage guarantee

The loan will be secured by a 1st degree mortgage on the asset and the building, located at 2, Teniente Ochoa Olalla Street, Madrid.

According to the appraisal report made by ATValor, the current appraisal amounts to €791,767.17. The loan to be made to the developer is 700,000 €, which means a Loan to Value (LTV) on the current appraisal of 88.41% and a Loan to Value of 1st disposal of 21.47%.

The HET appraisal (Hypothetical finished building) amounts to 1,438,826.36 €, which represents a Loan to Value HET of 48.65%.

Guarantee agent

The constitution, preservation, management, administration and, if applicable, enforcement of the real estate mortgage rights on behalf of the investors will be carried out by an entity external to wecity.

In this case the designated Collateral Agent is BONDHOLDERS.

Bondholders, is a professional company specialized mainly in providing independent commission agent and escrow services over different asset classes and under numerous international jurisdictions.

In recent years Bondholders has been mandated as agent and arranger in more than 400 transactions representing a total of nearly 200 billion euros in debt.

Its main clients include, among others, financial institutions, institutional clients, asset managers, sovereign government agencies.

Currently one of the leaders in Europe in providing independent fiduciary services.

Monitoring

The promoter must justify the use of the funds in each of the applications. The use of the funds by the promoter will be monitored by a company external to wecity..

Compliance 🇪🇺

Compliance with Regulation (EU) 2020/1503 of the European Parliament and of the Council of 7 October 2020 on European providers of crowdfunding services for companies:

Risk Warning

Investing in this crowdfunding project involves risks, including the risk of partial or total loss of the money invested. Your investment is not covered by deposit guarantee schemes established in accordance with Directive 2014/49/EU of the European Parliament and of the Council (). Your investment is not covered by investor compensation schemes established in accordance with Directive 97/9/EC of the European Parliament and of the Council (*). You may not receive any return on your investment. It is not a savings product and it is recommended that you do not invest more than 10% of your net assets in equity financing projects. You may not be able to dispose of the investment instruments at any time. Even if you are able to sell them, you may incur losses.

Pre-contractual cooling-off period for inexperienced investors

Inexperienced investors have a cooling-off period of four (4) days during which they may, at any time, revoke or withdraw, at any time, their investment offer or expression of interest in the equity financing offer without having to justify their decision and without incurring a penalty. The cooling-off period begins at the time the potential non-experienced investor makes an investment offer or expresses interest and expires after four calendar days from that date. To exercise their revocation rights, Investors may send an email to the following address: reclamaciones@wecity.com, filling in the “subject” field of such email as follows: “REVOCATION – Name of the Opportunity – Name and surname of the Investor”. In the event that you have made a monetary contribution linked to the financing offer, said amount will be returned as soon as possible to the wallet that, as an investor/user of the “WECITY” Platform, you have open with the “LEMONWAY” Payment Institution.

Credit risk

Credit risk is defined as the loss that may occur in the event of non-payment by the counterparty in a financial transaction. In this specific case, the risk that the Promoter does not pay the principal and/or interest on the Loan.

Sector risk Risks inherent to the specific sector.

Such risks may be caused, for example, by a change in macroeconomic circumstances, a reduction in demand in the sector in which the equity financing project operates and dependencies in other sectors. In any case the investor should be aware that adverse economic conditions or cyclical changes may lead to a weakening of the Promoter’s ability to meet its financial commitments in connection with the loan.

Risk of default

The risk that the project promoter may be subject to bankruptcy proceedings and other events affecting the project or the project promoter that result in the loss of the investment for the investors. Such risks may be caused by a variety of factors, including, without limitation: (serious) change in macroeconomic circumstances, mismanagement, lack of experience, fraud, financing not matching the corporate purpose, failure to launch the product or lack of liquidity. In the event of insolvency of the Promoter, the holders of the credits will be considered as credits with special privilege, as they are secured by a mortgage guarantee, in accordance with the cataloguing and order of priority of credits established by Royal Legislative Decree 1/2020, of May 5, which approves the revised text of the Insolvency Law (hereinafter, the “Insolvency Law”), except for those amounts that pursuant to Article 272 of the Insolvency Law must be classified either as ordinary credit or as subordinated credit, as appropriate.

Risk of lower or delayed yield

The risk that the return is lower than expected or that the project defaults on the payment of principal or interest.

Investment illiquidity risk

The risk that investors will not be able to sell their investment. There is no active trading market for the loan, so the investor may not be able to find a third party to whom to assign the loan.

Other risks

Risks that are, among others, beyond the control of the project developer, such as political or regulatory risks.